Property Location

The building is located in the eastern sector of the preferred financial district of the Perth CBD, on the southern alignment of St Georges Terrace, between Barrack Street and Sherwood Court. Accordingly, the building is directly north of Elizabeth Quay, and is in a precinct directly influenced by this development.

Property Description

The property comprises a ten-storey office building with two basement levels, constructed in 1972 as the headquarters of the Reserve Bank of Australia. It was extensively refurbished in 1995, and has had subsequent upgrades to lobbies and infrastructure. The building generally provides good standard B-grade office accommodation. It comprises substantial basement secure storage areas and provides only limited onsite parking in the form of 16 secure bays.

Tenancy and Leasing Information

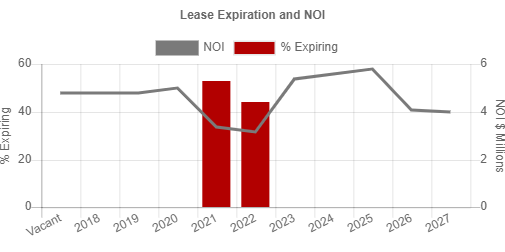

Spacecubed, a co-working hub, recently signed a 15 year lease for just over 2,000 square metres over two floors. Amcom renewed their lease over 1,100 square metres earlier in 2017. Other major tenants include Citic Pacific Mining and accountancy firm Crowe Horwath.

Sale & Tenancy details

| Sale Price | $53,569,416 |

|---|---|

| Sale Date | December 2017 |

| Purchaser | One CCW Pty Ltd |

| Vendor | Credit Suisse |

| Vacancy (by area) | 18.7% |

|---|---|

| WALE (by area) | 5.0 years |

| WALE (by income) | 5.6 years |

| Net Lettable Area (NLA) | 9905 m² |

|---|---|

| NABERS Rating | 4.5 star |

| Gross Passing Income | $5,620,480 p.a. |

|---|---|

| Gross Market Income | $6,556,906 p.a. |

| Adopted Outgoings | $1,625,017 p.a. |

| Net Passing Income | $3,995,463 p.a. |

| Net Market Income | $4,931,889 p.a. |

Analysis

| Passing Yield | 7.46% |

|---|---|

| Passing Yield (fully leased) | 9.30% |

| Market Yield | 8.46% |

| IRR | 8.66% |

| Terminal Yield | 8.50% |

| NLA Rate | $5,408/m² |

| Gross Passing Income | $567/m² |

|---|---|

| Gross Market Income | $662/m² |

| Adopted Outgoings | $164/m² |

| Net Passing Income | $403/m² |

| Net Market Income | $498/m² |

For further details please contact:

Gavin Chapman - Managing Director

gavin.chapman@pvawa.com.au

(08) 6500 3600

Property Valuation & Advisory (WA)

Unit 2, 168 Stirling Highway, Nedlands WA 6009

Follow UsThis analysis relies upon third party sources of information.While the resources are considered reliable, their accuracy cannot be guaranteed. We therefore accept no liability for any reliance on our analysis.